01 Nov Mastering Forex Swing Trading A Comprehensive Guide 1630978235

Mastering Forex Swing Trading: A Comprehensive Guide

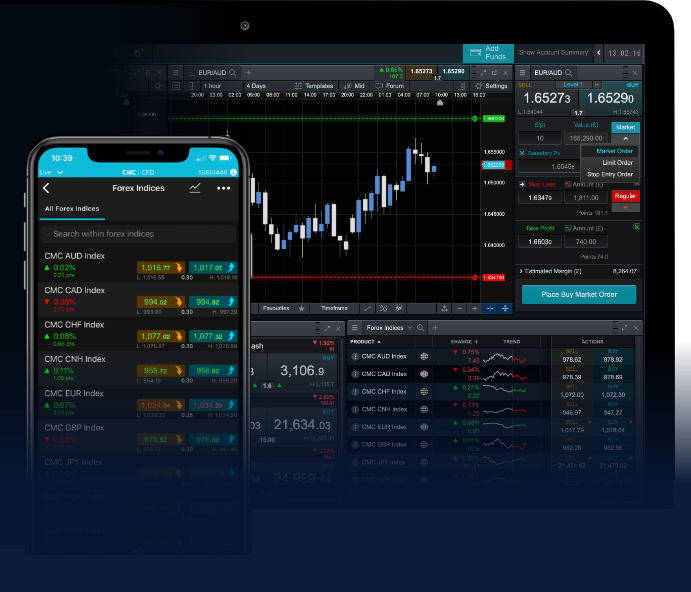

Swing trading in the Forex market is a strategic approach designed to capture price movements over a period of days to weeks. Unlike day trading, where positions are opened and closed within the same trading day, swing trading allows traders to take advantage of larger price swings in the market. This article will delve into the fundamentals of Forex swing trading, strategies, tips for success, and how to effectively manage risk. For more resources on trading, you can check out forex swing trading https://latam-webtrading.com/.

What is Forex Swing Trading?

Forex swing trading involves holding a currency pair for several days or weeks to capitalize on anticipated price movements. The trader analyzes the market for significant price swings, looking for optimal entry and exit points. This method is ideal for those who cannot dedicate their entire day to trading, allowing them to participate in Forex markets without needing constant screen time.

The Basics of Swing Trading

At its core, swing trading leverages market volatility and momentum. Traders use technical analysis, examining price charts, patterns, and indicators to identify potential entry points. The key to successful swing trading lies in recognizing market trends: whether a currency pair is trending up, down, or sideways, understanding these trends enables traders to make informed decisions. Here are some fundamental aspects of swing trading:

- Time frames: Swing traders commonly analyze charts on daily, 4-hour, or even 1-hour time frames.

- Technical analysis: This includes candlesticks, moving averages, and various indicators to guide trading decisions.

- Risk management: Establishing limits on losses (stop-loss orders) and determining position sizes based on account balance and risk tolerance are crucial.

Strategies for Successful Swing Trading

1. Trend Following

The trend-following strategy is about identifying the direction of the market and placing trades accordingly. Traders look for opportunities to enter trades when the market is demonstrating a strong trend. Tools like moving averages can help confirm the trend’s direction. For instance, if the price is above the 50-day moving average, a trader might consider entering a long position.

2. Reversal Trading

Reversal trading involves identifying points where the market is likely to change direction. This strategy often uses support and resistance levels, as well as various indicators (like RSI or MACD), to determine overbought or oversold conditions. Once a reversal signal is confirmed, traders can execute a trade anticipating the market will move in the opposite direction.

3. Breakout Trading

A breakout occurs when the price moves outside of a defined support or resistance level with increased volume. Swing traders can capitalize on breakouts by entering trades just before or after the breakout happens, expecting a significant momentum shift. It’s crucial to use stop-loss orders with this strategy to manage potential risks.

Utilizing Technical Indicators

Technical indicators enhance decision-making in swing trading by providing insights into market conditions. Commonly used indicators include:

- Moving Averages: These smooth out price data to identify trends. A crossover of short-term and long-term moving averages can signal entry and exit points.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping identify overbought or oversold conditions.

- Bollinger Bands: These bands are used to assess volatility and identify potential price reversals.

Risk Management Techniques

Managing risk is essential in swing trading. Here are several techniques that can help minimize losses and protect your trading capital:

- Set stop-loss orders: These automatically close a trade at a predetermined loss level, helping you minimize adverse movements.

- Position sizing: Determine how much capital to risk on a single trade based on your account balance and risk tolerance.

- Diversification: Spreading investments across multiple currency pairs can reduce risk exposure.

The Importance of Psychology in Trading

Trading psychology plays a significant role in a trader’s success. Emotions such as fear and greed can lead to poor decision-making. Establishing a disciplined trading routine and adhering to a well-defined trading plan is crucial. Here are some psychological tips for swing traders:

- Stick to your plan: Having a trading plan helps you remain focused and reduces impulsive decisions.

- Maintain a trading journal: Tracking your trades helps identify patterns in your performance and keeps you accountable.

- Practice patience: With swing trading, many trades may take time to play out. Being patient and not rushing can lead to better outcomes.

Final Thoughts

Forex swing trading offers a flexible and rewarding approach for traders looking to benefit from short to medium-term price movements. By understanding key strategies, utilizing technical analysis tools, and effectively managing risk, traders can navigate the markets with greater confidence. Always remember that trading involves risks, and continuous learning is essential to stay ahead in the dynamic Forex landscape.

Resources for Further Learning

Investing time in furthering your knowledge about Forex swing trading can enhance your skills significantly. Some valuable resources include:

- Investopedia: Swing Trading

- FXCM: Swing Trading Strategies

- TradingView: Charting and Analysis

With dedication and practice, you can master swing trading and make your mark in the Forex market.

No Comments